Advertisement

-

Published Date

February 3, 2019This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

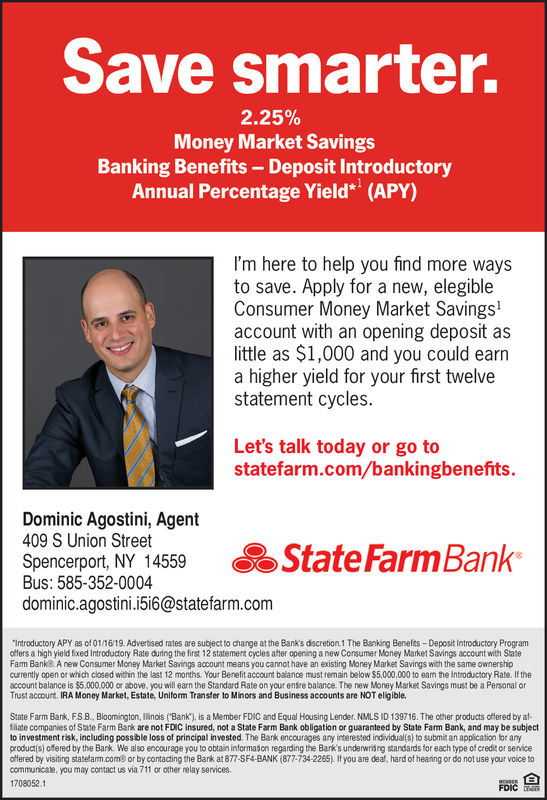

Save smarter. 2.25% Money Market Savings Banking Benefits-Deposit Introductory Annual Percentage Yield* (APY) I'm here to help you find more ways to save. Apply for a new, elegible Consumer Money Market Savings' account with an opening deposit as little as $1,000 and you could earn a higher yield for your first twelve statement cycles. Let's talk today or go to statefarm.com/bankingbenefits. Dominic Agostini, Agent 409 S Union Street Spencerport, NY 14559 Bus: 585-352-0004 dominic.agostini. 5i6@statefarm.com State FarmBank Introductory APY as of 01/1619. Adverbised rates are subject to change at the Banks dscretion.1 The Banking Benefes-Deposit Introductory Program offers a high yield fixed Introductory Rate durning the first 12 statement cycles after opening a new Consumer Money Market Savings account with State Farm Bank& A new Consumer Money Market Savings account means you cannot have an existing Money Market Savings with the same ownership currently open or which closed within the last 12 months. Your Benefit account balance must remain below $5,000,000 to eam the Introductory Rate. If the account balance is $5,000.000 or above, you wilearn the Standard Rate on your entre balance. The new Money Market Savings must be a Personal or Trust accourt. IRA Money Market, Estate, Uniform Transfer to Minors and Business accounts are NOT eligible. State Farm Bank, FS B., Bloomington, lanois (Bank), is a Member FDIC and Equal Housing Lender. NMLS ID 139716. The other products offered by af- fiate companies of State Farm Bank are not FDIC insured, not a State Farm Bank obligation or guaranteed by State Farm Bank, and may be subject to investment risk, including possble loss of principal invested. The Bank encourages any interested individual(s) to submit an application for any product(s) ofered by the Bank. We also encourage you to obtain informason regarding the Bank's underwriting standards for each type of credit or service offered by visiting statefam.comS or by contacting the Bank at 877-SF4-BANK (877-734-2265). If you are deaf, hard of hearning or do not use your voice to communicae, you may contact us via 711 or other relay services. 1708052.1